Standard Deduction 2025 Age 65 Married. Your standard deduction consists of the sum of the basic standard. $3,000 per qualifying individual if you are.

The 2025 standard deduction is $14,600 for single filers and those married filing separately, $29,200 for those married filing jointly, and $21,900 for heads of. You are considered age 65 at the end of the year.

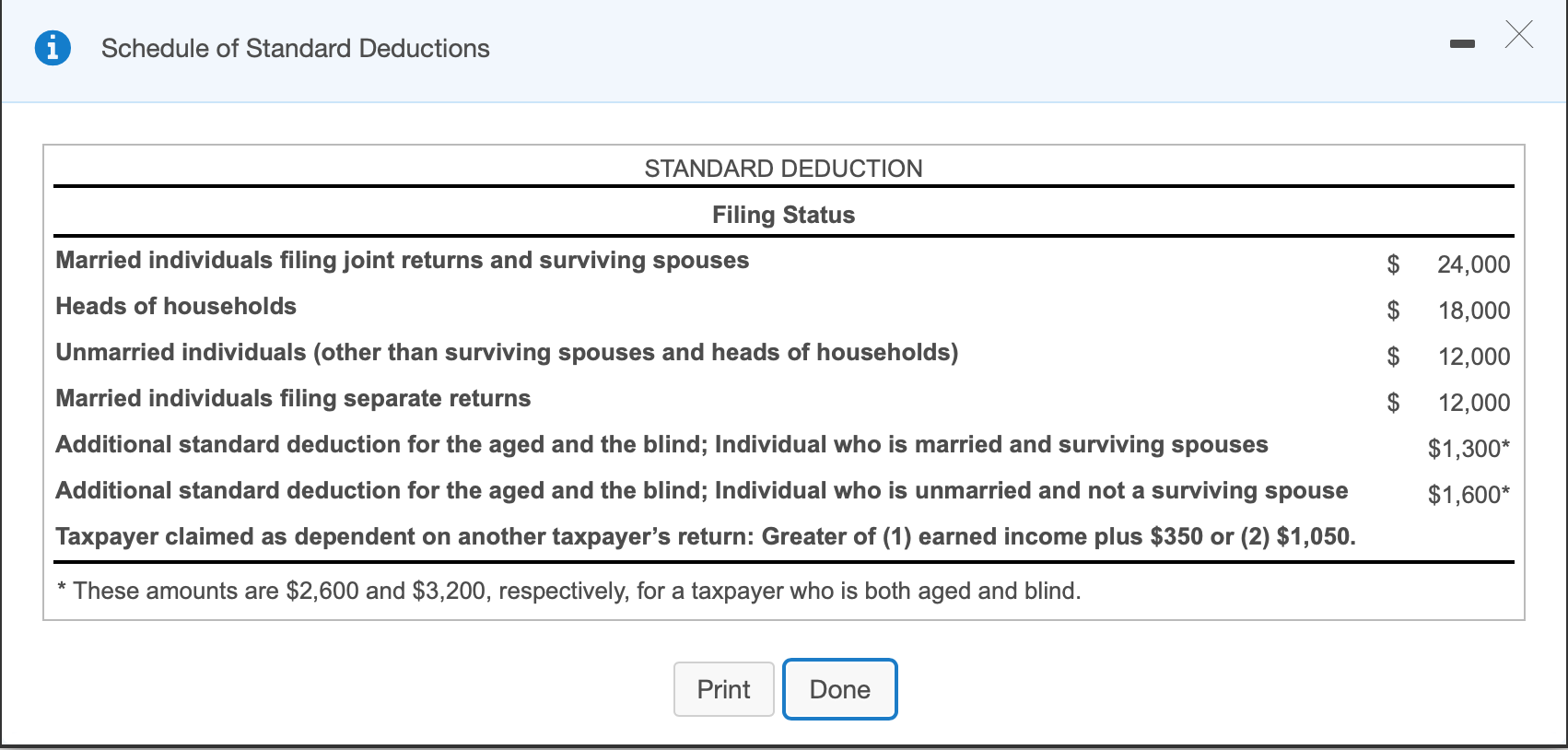

People who are 65 or older can take an additional standard deduction of $1,950 for single and head of household filers and $1,550 for married filing jointly,.

Standard Tax Deduction 2025 Over 65 Emmye Sheryl, The amount is adjusted for inflation each year, and varies based on the taxpayers filing status (single, married filing jointly, married filing separately, or head of. The additional standard deduction for age 65 is larger in the single filing status than the additional standard deduction per person for age 65 in married filing.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, Irs 2025 standard deductions and tax brackets meade scarlet, seniors over age 65 may claim an additional standard deduction. The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

Tax Year 2025 Standard Deduction For Seniors Rhody Cherilyn, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the amount for tax year 2025. The 2025 standard deduction is increased to $29,200 for married individuals filing a joint return;

Irs 2025 Standard Deduction Over 65 Tarah Francene, In 2025, for example, single taxpayers and married taxpayers who file separate returns can claim a $13,850 standard deduction. The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

Standard Irs Deduction For 2025 Lory Silvia, The 2025 standard deduction is $14,600 for single filers, $29,200 for joint filers and $21,900 for heads of household. The 2025 standard deduction is $14,600 for single filers and those married filing separately, $29,200 for those married filing jointly, and $21,900 for heads of.

2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, The standard deduction for those. If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

Tax Standard Deduction 2025 Rahel Latashia, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. $3,000 per qualifying individual if you are.

2025 Tax Brackets For Seniors Over 65 Kenna Melodee, In 2025, for example, single taxpayers and married taxpayers who file separate returns can claim a $13,850 standard deduction. The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both.

Standard Deduction Mfj 2025 Dode Nadean, In 2025, for example, single taxpayers and married taxpayers who file separate returns can claim a $13,850 standard deduction. People 65 or older may be eligible for a.

2025 Tax Brackets And Deductions Mela Stormi, If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year. Irs 2025 standard deductions and tax brackets meade scarlet, seniors over age 65 may claim an additional standard deduction.